Help Commercial Customers Get Equipment Covered Faster

Physical damage insurance (PDI), gap insurance, warranties, and extended service contracts should be part of any F&I process for an equipment dealer, just like it is for an auto dealership. With powerful online tools, Trnsact enables aftermarket providers to connect with a large network of dealers to create a seamless, digital process to offer products alongside financing. The result is more sales and greater efficiencies with a platform that is loved by dealers and commercial customers alike.

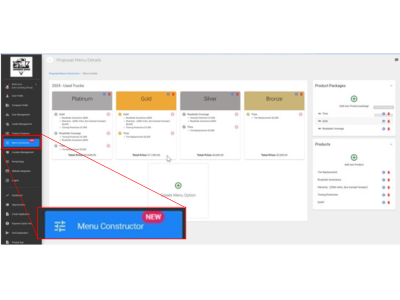

Digital F&I Menu with

Aftermarket Products

Benefits of Using TRNSACT to Scale F&I Revenue

Aftermarket Compliance

With increasingly tough state and federal regulations, a compliant, secure system is a necessity. Manual processes are not private, secure, or manageable. These days, it is vital to keep the entire financing process compliant and secure to minimize risk.

ACCESS TO DEALER NETWORK

Trnsact has established relationships with hundreds of dealerships and that network is growing by the day. Your products will be front and center for these dealers- and easily added to their financing process.

BETTER DEALER EXPERIENCES

Protection offerings are often viewed as an afterthought by dealers. With frictionless dealer experiences, your products will receive the support needed without creating any additional burdens on the dealer.

BETTER CUSTOMER EXPERIENCES

After the financing process, customers have little patience for aftermarket products. Trnsact offers a branded digital F&I menu where products can be sold seamlessly with monthly payment quotes for various options.

Hundreds of trucking and equipment dealers already use Trnsact to transform their financing, speed up the sales process, and drive more revenue on a compliant and secure platform.

Are you ready to offer aftermarket products to commercial equipment customers on the secure and compliant Trnsact platform? Book a quick demo with our commercial finance experts.